Is The Art World Getting Better At Attracting New Collectors?

Recent art market reports point to some encouraging signs

NOTE: Rather than summarizing the art industry’s most consequential report, I’m going to focus on an area I believe to be most vital to the industry’s longevity. Namely, checking in on its ability to identify and welcome new collectors. Let’s go.

I recently read McKinsey's The State of Luxury 2025 report, which was released in January. It was heartening to see that they came to the same conclusions that I'd reached back in August 2024 when I originally wrote Dear Galleries: Your Marketing Sucks. Respectfully. (reposted on Substack here):

We're in a different cultural moment. Today's potential art buyers come from diverse cultural, ethnic, and racial backgrounds and a broadening spectrum of gender orientations. In short, their identities play a significant role in that mix of needs, lifestyles, and interests that inform their choices.

The McKinsey report similarly notes:

Meanwhile, the luxury client base is becoming more diverse, and clients have a more complex relationship with luxury goods than ever. Having a differentiated value proposition that is appealing to this diverse client base is essential, given the anticipated low-growth environment.

It's also true that this more diverse cohort indeed tends to seek experiences over objects, as the report highlights. One of the recommendations is that luxury brands need to "rethink their client engagement strategy". For these brands, McKinsey is talking about investments in "tech, AI, and data capabilities" so that brands are better able to offer personalized experiences.

For the art world, it's not about big, expensive investments in technology. The first thing that needs to happen is a mindset shift that will get it thinking about attracting and engaging potential new collectors. The mass affluent cohort is still sitting on the sidelines, spending their money elsewhere. Meanwhile, most of the art world is doubling down on appeals to its (fading) boomer audience.

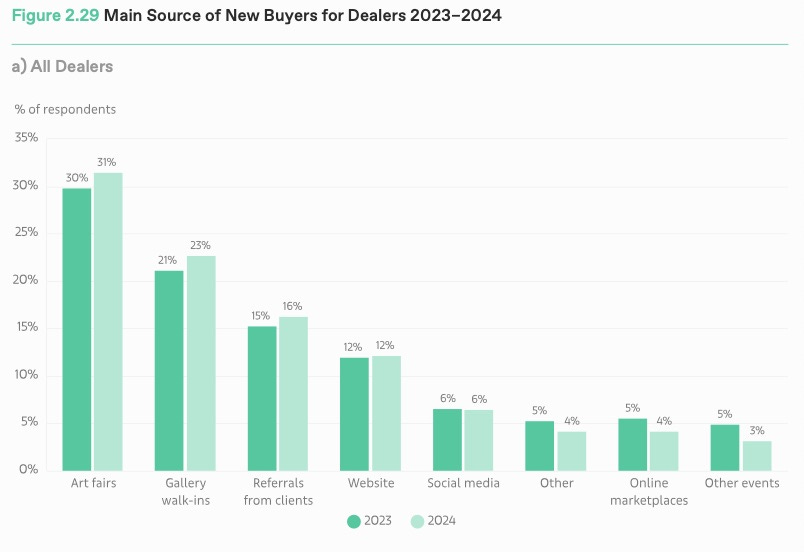

Notwithstanding the above, the news isn't all bad. According to the recently released 2025 UBS/Art Basel Art Market Report, some dealers have been successful in reaching new collectors. Some of these sales are due to new buyers coming into galleries. The other source of new buyers is through art fairs. One chart illustrates this:

Year-over-year, the numbers are up in both categories. Like I said, encouraging.

An important section of the report here:

Some dealers were successful in reaching new buyers, with 44% of the buyers they sold works to being new to their business in 2024. The share of sales to new buyers also increased to 38%, up by 5% from 2023.

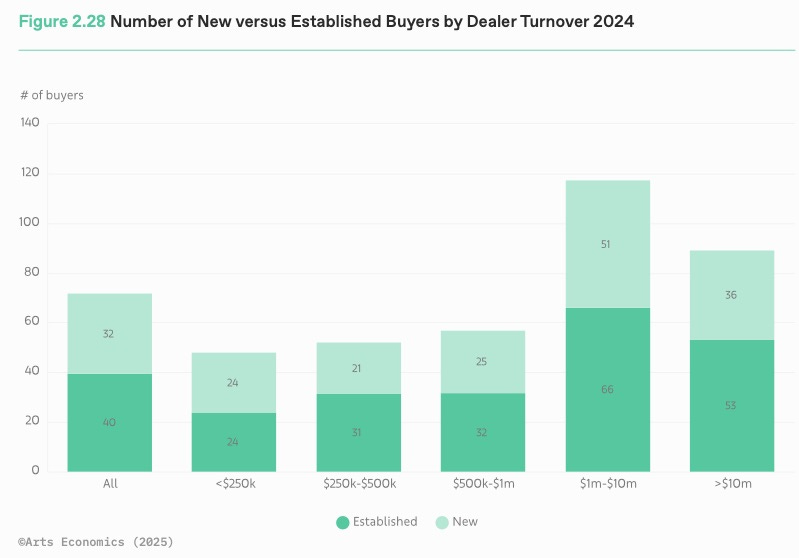

Further, the role of smaller galleries in onboarding new collectors can't be overlooked. The reason: Price points for works presented by smaller galleries tend to be lower. The above chart shows that for works under $250,000, galleries saw an equal number of new vs. established buyers. The report notes:

The share of new buyers was highest for the smallest dealers (50%) and to the extent that some of these may be new to the art market and starting off at lower price points highlights the importance of smaller galleries in expanding the market to a wider audience.

And it's not just smaller galleries: Larger galleries also report a significant share of buyers who are new to their business last year. The term "turnover" refers to the length of time between when a gallerist receives a work from an artist to the time when they sell it. Therefore, a "high turnover" means they're selling work relatively quickly. Here's the quote:

After broadening their base of buyers significantly over 2023, dealers with the highest turnovers in excess of $10 million pursued a more focused strategy in 2024, selling the highest-value works to a smaller group of collectors as the market at the high end became more challenging. However, even in this segment, dealers reported that 40% of their buyers were new to their business in 2024.(my emphasis)

The UBS/Art Basel makes this final point on affordability:

The number of sales taking place in lower price segments across the sector also increased over 2023 and 2024. In 2022, the share of transactions for prices of below $50,000 was reported as 73% and this rose substantially by 13% in 2023, stabilizing at 85% in 2024, as activity was more buoyant at lower levels for many dealers.

So there's still good news for artists, collectors, and dealers: Affordable pieces–those priced under $50,000–will still move. In fact, it's $5,000 that seems to be the magic number. According to recent data from The Observer, auction sales volume hit a record of 132,000 transactions. That volume was attributed to work at or under this price point:

According to the report, this growth is being driven primarily by an unprecedented wave of sales at the most accessible price point (under $5,000) as auction houses work to attract a new generation of buyers, particularly Gen Z and Millennials.

It's important to acknowledge that cultural change happens slowly, until it doesn't. When it does happen, it's because a tipping point is reached. Presently, the art world isn't there yet in terms of proactively courting potential buyers. An industry changes when it's forced to, when the pain of continuing along the well-worn path becomes untenable. Some galleries will make the change sooner than others and will become more active in their outreach to new collectors. Those are the galleries that will find themselves better positioned as their audience of traditional collectors inevitably shrinks and disappears altogether.

For the overall health of the industry, I hope that happens sooner rather than later.

Ready to start your art collecting journey?

Click here to book a 15-minute consultation with me!